Accenture, 2014Accenture. (2014). Circular Advantage: Innovative business models and technologies to create value in a world without limits to growth.

Aldersgate Group, 2012Aldersgate Group. (2012). Resilience in the Round: Seizing the growth opportunities of a circular economy.

Andersen, 2006Andersen, M. S. (2006). An introductory note on the environmental economics of the circular economy. Sustainability Science, 2(1), 133–140. https://doi.org/10.1007/s11625-006-0013-6

Bakker, den Hollander, van Hinte, & Zijlstra. 2014Bakker, C. A., den Hollander, M. C., van Hinte, E., & Zijlstra, Y. (2014). Products that last- Product design for circular business models. Delft: TU Delft Library.

Bastein, Roelofs, Rietveld, & Hoogendoorn. 2013Bastein, T., Roelofs, E., Rietveld, E., & Hoogendoorn, A. (2013). Kansen voor de circulaire economie in Nederland. TNO

Bocken, Bakker & De Pauw, 2015Bocken, N. M. P., Bakker, C., & Pauw, I. De. (2015). Product design and business model strategies for a circular economy. In Sustainable Design & Manufacturing Conference, 12-14 April. Seville, Spain.

Bocken, Short, Rana & Evans. 2014Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42–56.

Boons, Montalvo, Quist, & Wagner, 2013Boons, F., Montalvo, C., Quist, J., & Wagner, M. (2013). Sustainable innovation, business models and economic performance: an overview. Journal of Cleaner Production, 45, 1–8.

Braungart, McDonough & Bollinger, 2007Braungart, M., McDonough, W., & Bollinger, A. (2007). Cradle-to-cradle design: creating healthy emissions – a strategy for eco-effective product and system design. Journal of Cleaner Production, 15(13–14), 1337–1348.

Casado-Vara et al., 2018Casado-Vara et al. (2018). How blockchain improves the supply chain: case study alimentary supply chain.

CIWM, 2014CIWM. (2014). The Circular Economy : what does it mean for the waste and resource management sector? Retrieved from http://www.ciwm-journal.co.uk/downloads/CIWM_Circular_Economy_Report-FULL_FINAL_Oct_2014.pdf

Clavreul, Butnar, Rubio & King, 2017Clavreul, Butnar, Rubio & King (2017) Intra- and inter-year variability of agricultural carbon footprints – A case study on field-grown tomatoes.

ESA, 2012ESA. (2013). Going for growth: A pratical route to a circular economy. Retrieved from http://www.esauk.org/esa_reports/Circular_Economy_Report_FINAL_High_Res_For_Release.pdf

European Commission, 2014European Commission. (2014). Scoping study to identify potential circular economy actions , priority sectors, material flows and value chains. European Commission. https://doi.org/10.2779/29525

European Commission, 2016European Comission. (2016). Closing the loop New circular economy package. Retrieved from http://ec.europa.eu/environment/circular-economy/index_en.htm

Genovese et al., 2017Genovese, A., Acquaye, A. A., Figueroa, A., Koh, S.C. L., Sustainable supply chain management and the transition towards a circular economy: Evidence and some applications, Omega, Volume 66, Part B, 2017, Pages 344-357

Green Deal, 2018Green Deal. (2018). Ruim € 100 miljoen aan circulaire inkoopkracht in nieuwe Green Deal Circulair Inkopen.

Groothuis. 2014Groothuis, F. (2014). New Era. New Plan. Fiscal Reforms For An Inclusive, Circular Economy. Case Study the Netherlands. Austerlitz. Retrieved from http://www.ex-tax.com/files/4314/1693/7138/The_Extax_Project_New_Era_New_Plan_report.pdf

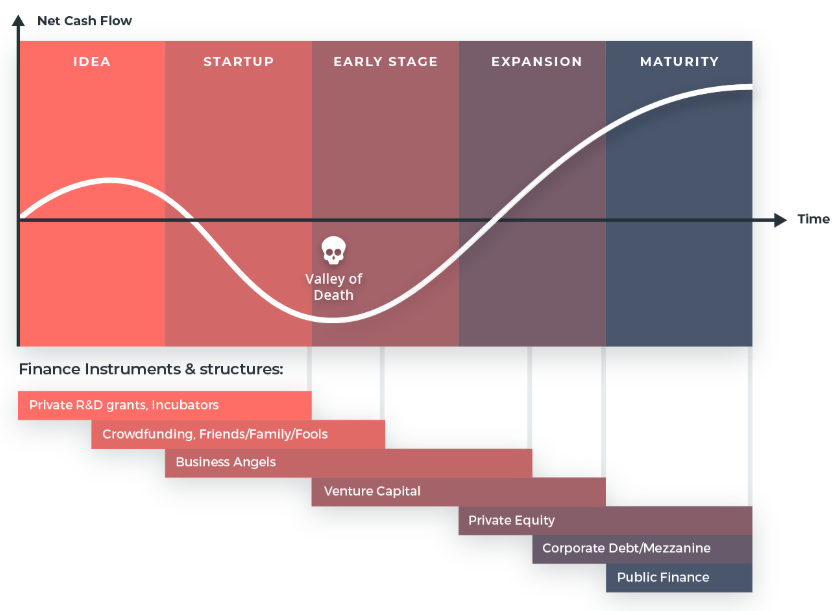

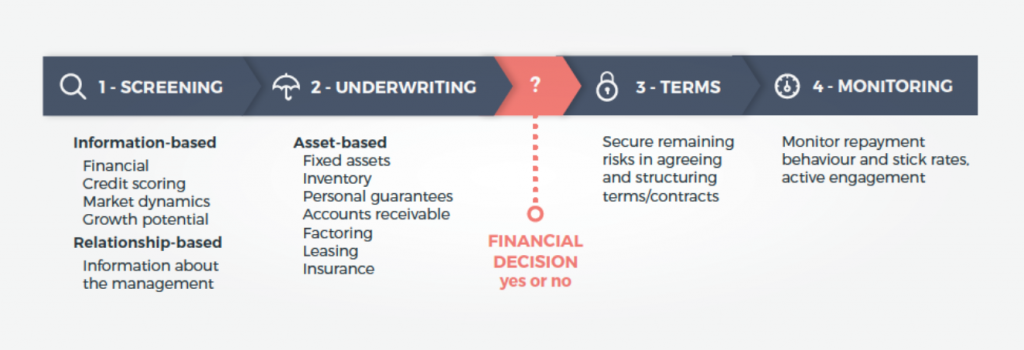

ING Economics Department, 2015ING Economics department. (2015). Rethinking finance in a circular economy. Retrieved from https://www.ing.nl/media/ING_EZB_Financing-the-Circular-Economy_tcm162-84762.pdf

Jonker & Dentchev, 2013Jonker, J., & Dentchev, N. (2013). Business Modeling for Sustainability: Identifying five modeling principles and demonstrating their role and function in an explorative case study. In Proceedings for the 8th Europen Conference on Innovation and Entrepreneurship: ECIE 2013. (pp. 340–346). Academic Conferences Limited.

Jonker, Tap, van Straaten. (2012)Jonker, J., Tap, M., & Straaten, T. van. (2012). Nieuwe Business Modellen: E en exploratief onderzoek naar veranderende transacties die meervoudige waarde creëren (Duurzaam Organiseren). Nijmegen. Retrieved from http://www.degroenezaak.com/upload/documents/WP Nieuwe Business Modellen Jan Jonker e.a.pdf

Jordans, 2016Jordans. (2016). Building a Collaborative Advantage within a Circular Economy: Inter-Organisational Resources and Capabilities of a Circular Value Chain.

Joyce, Paquin, & Pigneur, 2015Joyce, Paquin, & Pigneur. (2015). The triple layered business model canvas: a tool to design more sustainable business models.

Kirchherr, Reike & Hekkert. 2017Kirchherr, J., Reike, D., & Hekkert, M. (2017). Resources , Conservation & Recycling Conceptualizing the circular economy : An analysis of 114 definitions, 127(April), 221–232. http://doi.org/10.1016/j.resconrec.2017.09.005

Kjaer, Pigosso, Niero, Bech & McAloone, 2019Kjaer, L., Pigosso, D., Niero, M., Bech, N., & McAloone, T. (2019). Product/Service-Systems for a Circular Economy: The Route to Decoupling Economic Growth from Resource Consumption? Journal of Industrial Ecology, 23(1), 22-35.

Kok, Wurpel, & Ten Wolde. 2013Kok, L., Wurpel, G., & Wolde, A. Ten. (2013). Unleashing the Power of the Circular Economy. Report by IMSA Amsterdam for Circle Economy. Retrieved from http://scholar.google.com/scholar?hl=en&btnG=Search&q=intitle:Unleashing+the+Power+of+the+Circular+Economy#2

Kok, Wurpel, & Ten Wolde. 2013Kok., L., Wurpel, G. & Ten Wolde, A. (2013). Unleashing the Power of the Circular Economy. Report by IMSA Amsterdam for Circle Economy. Retrieved from http://mvonederland.nl/system/files/media/unleashing_the_power_of_the_circular_economy-circle_economy.pdf

Korhonen, Honkasalo, & Seppälä, 2018Korhonen, J., Honkasalo, A., & Seppälä, J. (2018). Circular Economy: The Concept and its Limitations. Ecological Economics, 143, 37-46.

Korhonen, Nuur, Feldmann & Birkie, 2018Korhonen, J., Nuur, C., Feldmann, A., & Birkie, S. (2018). Circular economy as an essentially contested concept. Journal of Cleaner Production, 175, 544-552.

Kraaijenhagen, Van Oppen & Bocken. 2016Kraaijenhagen, C., Van Oppen, C., & Bocken, N. (2016). Circular Business – Collaborate and Circulate. (C. Bernasco & L. Goodchild-Van Hilten, Eds.) (1st ed.).

Lüdeke-freund, 2009Lüdeke-freund, F. (2009). Business Model Concepts in Corporate Sustainability Contexts: From Rhetoric to a Generic Template for’Business Models for Sustainability’. Centre for Sustainability

Manu, Ankrah, Hammond, Wood,Baffour-Awuah, & Hingorani. (2014).Manu, E., Ankrah, N. A., Hammond, F., Wood, P., Baffour-Awuah, K., & Hingorani, N. (2014). The Valuation Tool User Guide: Monetizing Cradle to Cradle. C2C Bizz.

Mentink, 2014Mentink, B. (2014). Circular business Model Innovation. Technical University Delft.

Mentink, 2014Mentink, B. (2014). Circular business Model Innovation. Technical University Delft.

Milgro, 2019Milgro. (2019). Onderweg naar Zero Waste met Royal FloraHolland.

MVO Nederland, 2014MVO Nederland. (2014). Wegwijzer Circulair inkopen. Retrieved from http://mvonederland.nl/wegwijzer-circulair-inkopen-0#tab=pane-title-step-1

Nasir et al., 2017Nasir, M.H.A., Genovese, A., Acquaye, A.A., Koh, S.C.L., Yamoah, F., Comparing linear and circular supply chains: A case study from the construction industry, International Journal of Production Economics, Volume 183, Part B, 2017, Pages 443-457.

OPAi, & MVO Nederland, 2004OPAi, & MVO Nederland. (2004). Ondernemen in de circulaire economie “nieuwe verdienmodellen voor bedrijven en ondernemers.”

Osterwalder, Pigneur, & Tucci. 2005Osterwalder, A., Pigneur, Y., & Tucci, C. . (2005). Clarifying business models: Origins, present, and future of the concept. Communications of the …, 15(May). Retrieved from http://aisel.aisnet.org/cgi/viewcontent.cgi?article=3016&context=cais

Padding, Croon, Haastrecht, & Dijkstra, 2015Padding, T., Croon, G., Haastrecht, D. Van, & Dijkstra, R. (2015). Een kader voor circulair inkopen. Retrieved from https://www.pianoo.nl/sites/default/files/documents/documents/kadercirculairinkopen-20april2015.pdf

PBL, 2017PBL. (2017). Fiscale vergroening: belastingverschuiving van arbeid naar grondstoffen, materialen en afval.

PBL, 2018aPBL. (2018a). Circulaire economie: wat we willen weten en kunnen meten.

PBL, 2019aPBL. (2019a). Opportunities for a circular economy.

PBL, 2019bPBL. (2019b). Circulaire economie in kaart.

PianOo, 2012PianOo. (2012). Cradle to Cradle inkopen? Hoe doe je dat in de praktijk? Leerresultaten van een groep inkopers.

PIANOo, 2016PIANOo. (2016). Het inkoopvolume van de Nederlandse overheid.

Pianoo, 2019Pianoo. (2019). De overheid als launching customer.

Plan C, 2013Plan C (2013), Business Model Innovation Grid, http://www.plan-c.eu/bmix/

Plastic Pact, 2019Plastic Pact. (2019). Plastic Pact NL koplopers gaan voor meer met minder plastic in de circulaire economie.

Poppelaars, 2014Poppelaars, F. (2014). Designing for a circular Economy: The conceptual design of a circular mobile device. Schmidt MacArthur fellowship.

Preston, 2012Preston, F. (2012). briefing paper A Global Redesign ? Shaping the Circular Economy. Retrieved from https://www.chathamhouse.org/sites/files/chathamhouse/public/Research/Energy, Environment and Development/bp0312_preston.pdf

Rijksoverheid, 2014Rijksoverheid. (2014). Van Afval Naar Grondstof – Uitwerking van acht operationele doelstellingen. Retrieved from https://www.rijksoverheid.nl/documenten/rapporten/2014/01/28/van-afval-naar-grondstof-uitwerking-van-acht-operationele-doelstellingen

Rizos, Behrens, Kafyeke, Hirschnitz-Garbers, & Joannou. 2015Rizos, V., Behrens, A., Kafyeke, T., Hirschnitz-garbers, M., & Ioannou, A. (2015). The Circular Economy : Barriers and Opportunities for SMEs, Centre for European Policy Studies.

RSA, 2013RSA. (2013). Investigating the role of design in the circular economy. Retrieved from http://www.greatrecovery.org.uk/resources/the-great-recovery-report/

RVO, 2016RVO. (2016). Factsheet Eurostars-2. Retrieved from https://www.rvo.nl/sites/default/files/2016/01/Factsheet Eurostars.pdf

RWM, 2014RWM. (2014). EVER-DECREASING CIRCLES: closing in on the circle economy. Retrieved from http://www.rwmexhibition.com/files/rwm14_ambassadors_doc.pdf

Sociaal-economische Raad (SER), 2016Sociaal-economische Raad (SER). (2016). Werken aan een circulaire economie : geen tijd te verliezen. Retrieved from https://www.ser.nl/~/media/db_adviezen/2010_2019/2016/circulaire-economie.ashx

Stahel, 2010Stahel, W. (2010). The Performance Economy (2nd ed.). Palgrave Macmillan. Retrieved from http://www.palgraveconnect.com/pc/doifinder/view/10.1057/9780230274907

Supply Value, 2016Supply Value. (2016). Afval bestaat niet! – Een onderzoek naar de knelpunten en succesfactoren bij het toepassen van circulair inkopen in de praktijk.

Teece, 2010Teece, D. J. (2010). Business Models, Business Strategy and Innovation. Long Range Planning, 43(2–3), 172–194.

The Terrace, 2011The Terrace. (2011). Cradle to cradle Loont! Chart. https://doi.org/10.4324/9781849772709

Themakring Cradle-to-cradleThemakring Cradle-to-cradle, (2012). Cradle to Cradle inkopen? Hoe doe je dat in de praktijk? Leerresultaten van een groep inkopers. PianOo

Van Eijk, 2015Van Eijk, F. (2015). Barriers & Drivers towards a Circular Economy.

Van Veldhoven, 2018Van Veldhoven. (2018). Kamerbrief met kabinetsreactie op de transitieagenda’s circulaire economie.

VANG, 2016VANG (2016). Voortgangsrapportage van afval naar Grondstof.

Vermeulen, W. J. V, Witjes, & Reike, (2014)Vermeulen, W. J. V, Witjes, I. S., & Reike, D. (2014). Advies over een Raamwerk voor Impactmeting voor Circulair Inkopen, (SEPTEMBER 2014), 1–20. https://doi.org/10.13140/2.1.2270.2086

VNO-NCW, 2019VNO-NCW. (2019) Versnellingshuis laat circulaire economie vliegen.

Working Group Finance, 2016Working Group FinanCE. (2016). Money makes the World Go Round: and wil it help to make the economy circular as well? Retrieved from https://www.ellenmacarthurfoundation.org/assets/downloads/ce100/FinanCE.pdf

Working Group FinanCE. 2016Working Group FinanCE. (2016). Money makes the World Go Round: and wil it help to make the economy circular as well? Retrieved from http://sustainablefinancelab.nl/files/2016/04/FinanCE-Digital.pdf